10.31.2019

My future, hopefully

I cannot present my document on future dividends with real values until the last of January next year. It is so exciting to see if the document matches the reality.

No significant change

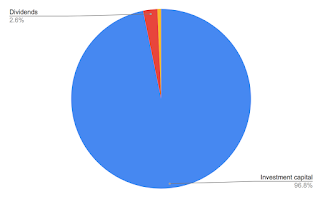

Overview of Family First's portfolio by today's date. It is not visible but 2 companies, TSLX and VET, have been added. Since a large acquisition in a single share is required for a change to be seen, this hardly differs from the first chart.

Dislikes that I do not have accumulated values available

When we started investing in dividend shares, I had no idea that I would want to know what values that make up our portfolio. All I wanted at that time was to start trading in shares so that I could receive dividends that I could reinvest and so on.

I have created a document that shows the proportion of invested capital, dividends and added value or reduction of our portfolio value. During the first few months, the bars will be a little difficult to interpret, but over time it will become clear.

Make money while you sleep or work until you die!

Having already reached last year's total dividends is fantastic. The larger the dividends, the later this day will come. How big the increase compared to last year will be remains to be seen. Most dividends are set for the rest of the year. Which shares we buy in the near future may affect the final result.

10.30.2019

Tax return

Finally, we are fully invested at Nordnet. From now on, all dividends will be moved to Nordea, where the foreign tax will be refunded immediately. Another addition to our savings is that from next year we will receive the foreign tax we paid in 2017 paid to us. The estimated payout date is February 2020.

Work smarter, not harder

I work hard, not smart. Apparently.

You know you have a lot at work when you forget that you have money to invest. Late last night I realized that I have just under $750 standing at Nordnet. Unfortunately, the stock exchange had already closed. Tomorrow I will receive the last dividend of the month, NRZ.

10.28.2019

Spreadsheet is God's gift to number nerds

I feel so confident that my spreadsheet is correct that I promise to show a chart with my calculated sum compared to the actual outcome, regardless the result. I have already created the document that is just waiting for the numbers to be entered.

An amount that I am confident in

I have decided on a sum when my weakest dividend month is only weak and not bad. When I have reached that sum, I will, in my own opinion, have a high lowest level. I expect to reach this level before the turn of the year 2021/22.

10.27.2019

If you want to be certain something gets done, do it yourself

We have assets in 3 banks. Different banks support different ways of providing information. Ideally, I would like to merge these three banks into one. Since this is beyond my control, I've had to do the next best thing, create all the features myself.

10.26.2019

Pride goes before a fall

My greed can come back to bite me. I have continued my acquisition of WPG. Another hundred or so are in my possession. The only thing is that they have gone up in price lately.

What is wrong with today's children?

Even if my son is perfect, there is a trait he has that I do not understand. Many of our friends' children are the same. When I was a kid, there was no chance I could stay away from the Christmas presents. Although my parents hid the presents, I found them and managed to open and reseal them many times. Without leaving any traces. The best were the Christmas presents with glossy paper, they were the easiest to open.

I've lost control

All the tests and projects that I helped the world's most perfect child with this week and put the last to the closing before the auditors come in late November have really taken its right.

Several weeks ago I invited some friends over for dinner. Since I had an incredible workload this week, I asked my husband to buy everything. This morning my husband asked me what time the guests are coming tonight so we could plan the cooking etc. I look at my calendar and find out that it's the first next weekend. Think I'll try to take a day off someday soon ...

10.24.2019

I love numbers

The satisfaction of seeing the forecast match the actual outcome is difficult to explain to someone who is completely uninterested. So far, the outlook for October's dividends seems to follow reality. Not much can match that contentment. Only last January next year will I know with 100% certainty if my document is complete.

The only major dividend remaining this month is NRZ. After that it will be 2 slightly poorer months. I have to decide when my weakest dividends months are not bad anymore, but only weak against my strong ones.

Young master Dewlar's chaos continues and I get cash

The offspring's week of hell continues and has been extended by two more tests tomorrow.

I myself have received dividends. Both yesterday and this morning I woke up to pleasing notifications. The dividends of BDCL, MPRL, REML and SMHD has been turned into real money in the account.

I bought both GPMT and NMFC and still have almost $1,500 unplaced. Tonight I will buy the last shares at Nordnet. I still have 30 GPMT left to buy. Thereafter, all holdings that can be traded are leveled to even hundreds.

10.22.2019

5G vs fiber

Earlier generations of mobile networks we have received early compared to the outside world. However, we seem to have to wait for 5G.

Home sweaty home

There have been chaotic days here at home.

The final work with the financial statements in combination with a son who did not really grasp this with checking Managebac for upcoming projects and tests has not been good for us.

Last Saturday he discovered that this week will be very intense, to say the least, for him. Yesterday he had PE test, today it was Spanish test, tomorrow it is I and S project, on Thursday he has an English test, mathematics test and another Spanish test.

10.20.2019

Savings will be limited for the rest of the year

As we, to the great joy of my and the world's most perfect child, are going to celebrate Christmas in our home for the first time ever, planning is in full swing. The world's most perfect husband is not as impressed.

No savings other than reinvesting the dividend will hardly happen. I'm going all-in on Christmas presents for the son this year. Yesterday we bought the first Christmas presents of the year. I took out the Christmas bag and placed it in a corner. Thankfully, it's white and not particularly eye-catching. I think I'm the one most excited for all the Christmas presents.

Trying to look into the future

Today we have been out for a walk, 10K, in the typical autumn weather. The rain was almost like a thin summer rain, but without the heat.

Now we have lit a fire in the tiled stove and cozy up on the sofa. Mr Dewlar took his computer. He usually checks the packaging companies on a regular basis. According to him, they show a first indication of the business cycle. A sale always requires some kind of packaging. The next report will be submitted at the end of the month, to his great dismay.

10.19.2019

Dividend stocks vs growth stocks

We have chosen to invest in dividend shares instead of growth shares. The reason for this is to get money paid to us monthly or quarterly that we can put to work in different ways.

Changed conditions... and not in a good way

Many years ago, the Swedish state encouraged private pension savings. The state was so eager that an amount up to $2,400 was fully deductible. This saving would be tax-exempt until you started to withdraw money from the funds/shares. The age was set to 55.

After a number of years, the right of deduction was removed and a few years later they even began to tax these holdings. Such a breach of contract could never have been carried out in the private sector.

War is never good, regardless of form

Yesterday, trade tariffs came into force between the EU and the US for industrial and agricultural products, European aircraft, etc. With different percentage surcharges.

The country I live in shows all the signs that we are the end of a boom. This will not improve the situation. Personally, I can only state that it currently feels better that we invest our money in American companies.

10.17.2019

Feeling pleased

Today's dividend resulted in 25 shares in NMFC, now I only need to buy 25 more to have an even hundred on Nordnet. I miss 60 shares of GPMT and 25 NMFC, which is about $1,100.

Better late than never

We purchase dividend shares instead of, like many others, growth shares. As I mentioned earlier, I am annoyed with myself because I have not followed up on how much investment capital, dividends or share price changes constitute our portfolio.

Ka-ching

Like most of the world's population, I am a routine person. Except for the TV, there are no technology gadgets in our room or our son's bedroom. Among the first thing I do every morning is to check my cellphone for e-mails or texts that needs to be dealt with.

10.16.2019

Christmas lights

Living in Scandinavia this time period is challenging. Short days that gets more dull due because of rain is not a dream scenario. What lights up the October darkness is all my dividends. November is one of our absolute darkest months. It feels even darker because we still tread towards the darkness. It is only after December 21 that we begin to move towards brighter times.

10.15.2019

My luck persists

Today is a good day to be me. I am very pleased with my yesterday's purchase of WPG. To top it off, both OHI and NEWT announced that they are raising their dividend today.

I'm winner

Usually when I buy a share they usually lose value immediately afterwards. This time it was exactly the opposite. I bought WPG yesterday and today they have increased by 3.6%. It feels good to be able to trade at exactly the right time, even if it was more luck than skill. Apparently luck is blind and can affect anybody!

10.14.2019

One small step for my portfolio

A smaller amount saved meant that I could buy another 100 WPG today. Although I sometimes feel that progress is small, I appreciate every little purchase.

10.13.2019

I want to strengthen my weak months

Next week will also be weak in terms of dividends. I will receive dividends from ARI, MAIN, SCM and STWD. Then I will have to wait for almost a week before the really big dividends land on the account.

It will be great fun to make some decent purchases. Last was in April of this year. I intend to buy WPG. Their yield in the combination that they have payouts during March, June, September and December which are weak months for me makes the temptation far too great to resist.

A devilish mother

Tomorrow it is parent teacher conference at school. For the past two weeks, the world's most perfect child has asked me every day if I have booked any appointment for the parent teacher conference. The school first opened the time booking on Wednesday so when I had booked I informed him that on Monday it is time.

During Thursdays, Fridays and Saturdays I have several times a day received small hints of things that may come up during these conversations. I know that the offspring is an ambitious student while also knowing that he is a pre-tween with all that it means. I'm convinced that the conversations will go well, but I'm not going to say that to Junior. I enjoy to see him sweating like a water pitcher.

10.12.2019

The uncertain future leads to a difficult wait

At the moment, it feels like we are in a vacuum. Seems like many are awaiting what will happen with the ongoing trade wars America vs. China and EU vs. America.

Since there seem to be various economic interests that affect the EU the most, there is a bit of a waiting room right now until the trade war ends. Everyone wants to make maximum money but is not willing to pay the price. Take the car industry as an example. Initially it was cheaper to install a computer program and trick the test machines to show an approved result than to actually create an engine that met the requirements.

10.11.2019

Another Green Day paper trading

Today I have completed 2 of my final accounts. When I work, I get completely consumed by the work. I had planned to keep track of the pre market so I could prepare a smaller purchase of WPG.

10.10.2019

Book smart vs. street smart

The world's most perfect child, who is in sixth grade in the International Baccalaureate (IB) Middle Years Program (MYP), is surprisingly willing to study. I am indescribably proud. As a student in IB MYP, he must make a certain number of SA hours to be approved.

As a Scandinavian, we have no natural upbringing of doing charity. One project that counts him hours is to decorate the school for the Halloween party.

He showed me the note he had written to his teacher to sign up for the Halloween party quote "I'm happy to help with the preparation for the Halloween party because I want to get rid of my SA hours as soon as possible" unquote. I helped him reformulate the letter so his chance to participate increased. Sometimes you have to be street smart.

I ❤️ Google Sheets

Opened my favorite document with all our holdings where I made several links to Google Finance. One link is between the American dollar and the Swedish krona.

I was very surprised when I saw that the American dollar had weakened since last night. When I asked the world's most perfect husband if he knew why, I was told that our counterpart to the Federal Reserve Bank had said something that had a positive effect on the currency.

10.09.2019

October looks to be a good month

I have re-evaluated the American dollar value. There is much talk that the dollar will continue to strengthen against our local currency. This means that my 5 factors seem to be in my favor during one of my strongest dividend months.

Same same but different

Knowing that cultures can be very different is important to know. This applies to all cultures, including corporate cultures. Values, procedures, routines, computer systems and so on can vary widely between different companies. This means that many mergers, acquisitions etcetera more often become a costly rather than a saving.

A clear example of different corporate cultures is the difference between, for example, Nordnet and Nordea in terms of dividends. At Nordea, I receive the money and first the following day am I notified of which company the dividend is for. The same dividend at Nordnet takes about 2 days further compared to Nordea. It's no secret that I prefer Nordea.

10.08.2019

Assume that some of the experts have hidden clients

For several years I have heard, read and seen various "experts" advises borrowers to choose fixed interest rates for their mortgages. Historically, it has always been worthwhile to have variable interest rates on their mortgages.

I was about to fall off the chair when I heard the expert on TV this weekend advising people to choose variable interest rates for their mortgages. The amount saved with variable interest rates could be invested in funds or shares as a buffer in the event of an interest rate increase.

One week rich, the other week poor

This week is last week's absolute opposite, not a single dividend so far. This dry season will last until about October 25. The days around that date will be the absolute highlight of the month when it comes to dividends. Over 60% of the month's total dividend is credited to the account during this period.

10.06.2019

Bad day at the office

When I have a bad day at work, I think of the three countries in G7 which, unlike their colleagues, have a plus interest rate. Being a minority cannot be easy, especially not among that company and responsibility.

10.05.2019

It is never to late

One thing that has annoyed me for a long time is that we have no idea at all how much our saved money and our dividends account for in relation to our portfolio value. Since we have 3 banks and changed savings form during our investment years, there is absolutely no way to track the money either.

For the first time ever

Last year we celebrated Christmas and New Year in Bangkok. It was just our little family. The holiday was absolutely fantastic except for the Christmas Eve and Christmas Day itself. The offspring and I had a very hard time bringing up the Christmas feeling in the tropics at a hotel as opposed to the world's most perfect husband who loved it.

It's been a good week

It has not disturbed me at all that the autumn with its colder weather and rain has come to my city. I think this has been my first week ever that I received payouts every day. A very enjoyable experience.

10.04.2019

Equalization was all I tried to think about

Last night the world's most perfect child was away with a friend and played Dungeons & Dragons for the first time. To relieve the anxiety that the offspring is growing up far too quickly, I logged into the bank and bought some securities for the dividend that came in earlier this week.

Lucrative nights

All this week I have had the great privilege of waking up every day to the mobile screen full of notifications with information that various dividends have been added to the account. In the best of all worlds, this would be a recurring theme throughout the year.

10.03.2019

Should speed up the payout pace

Yesterday I sold all my holdings of AGNC and SCM in one of my pension insurances. I reinvested the entire amount in OXLC. It will be exciting to see how much this redistribution of capital will affect the dividend rate and portfolio value.

10.02.2019

The experiment part VIII

Inch by inch increases my holding in OXLC. Every month after the acquisition, I expect the stacks to be more equal than they are. I become equally disappointed every time.

Losing another

Another hardship for WPG. After losing Sears as a tenant earlier this year comes another setback for WPG, Forever 21.

Fortunately, Forever 21 was a much smaller tenant, but it affects the belief in the company and therefore the share price. Since I invest in dividend shares and their return is indescribably good, I will continue to acquire shares when I have the opportunity. Should they start lowering the dividend, I will reassess my decision.

Time flies

A couple of days ago it was 25 years since the world's most perfect husband and I started dating. Earlier this year we celebrated 15 years as married and 20 years as engaged. The world's most perfect child was born on our 3-year wedding anniversary.

Subscribe to:

Posts (Atom)

The sum of all vices is constant

After my visit to the dermatologist which ended with me having to contact another doctor to get a referral for blood lipid testing, I have ...

-

The best month of the year is finally here, January. Not only due to my birthday, more importantly the largest dividends of the year. Ja...

-

I hoped that even today I could wake up to notifications that money had been entered into my account. But no. I'd rather sleep like Scro...

-

In my eagerness to buy securities to update my new Google Sheet, I almost bought the wrong securities. Fortunately, the purchase did not go ...